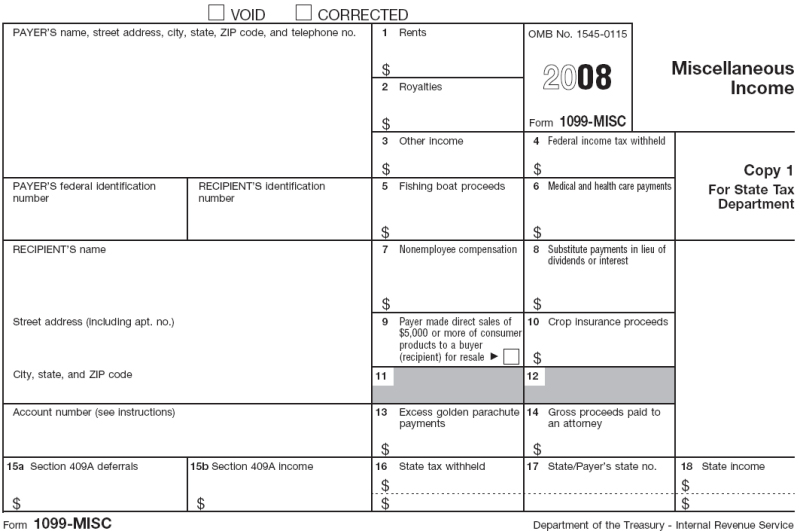

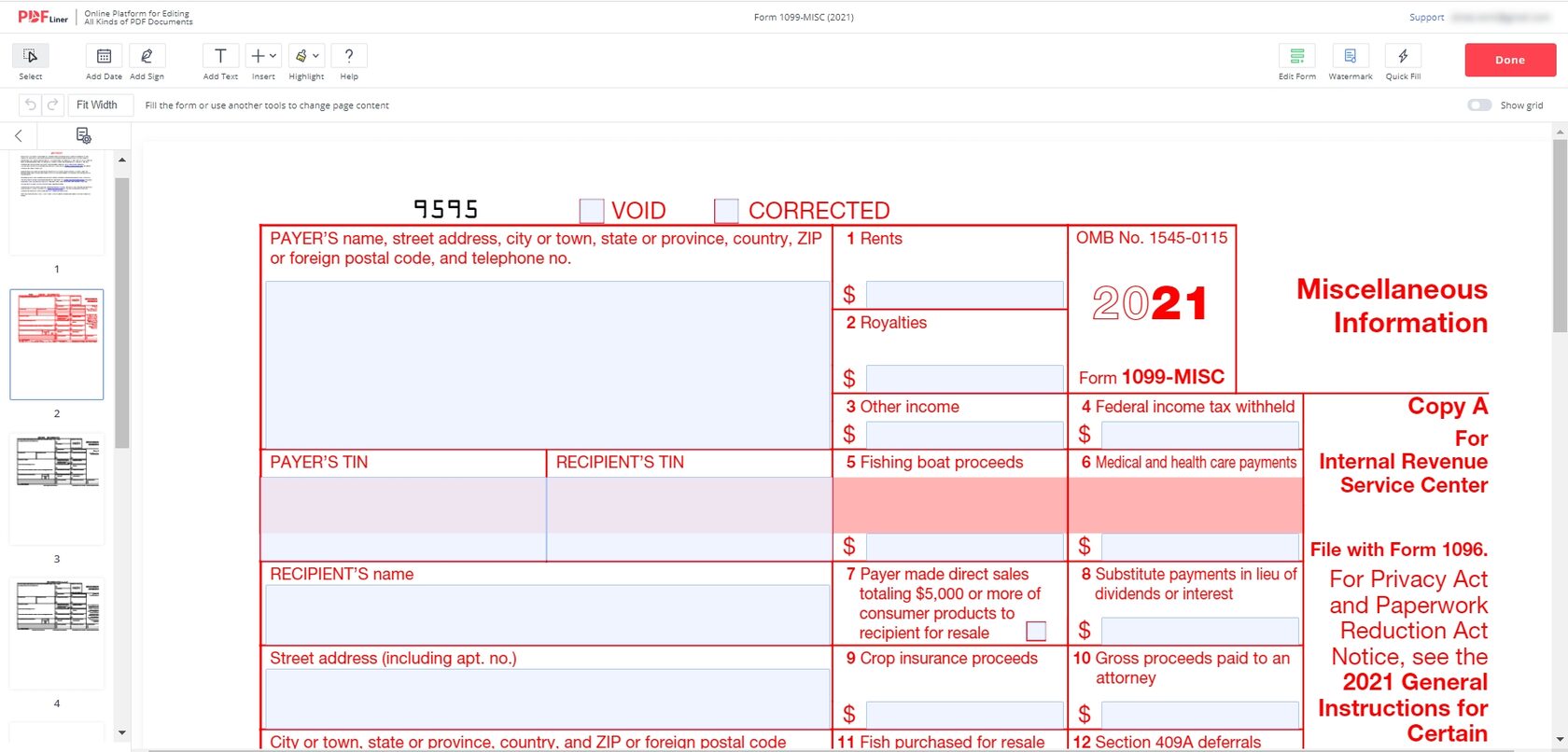

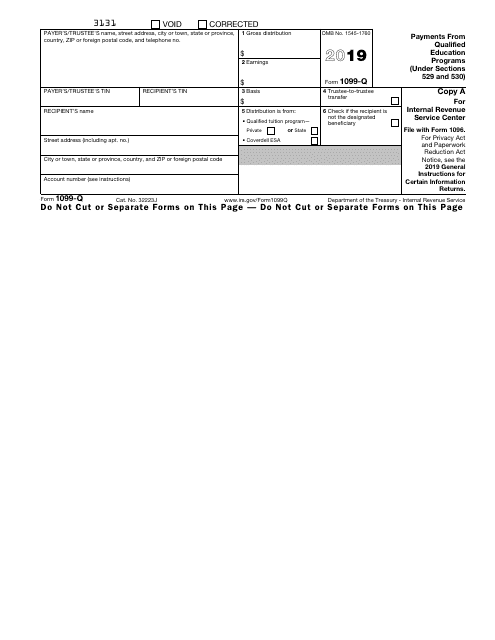

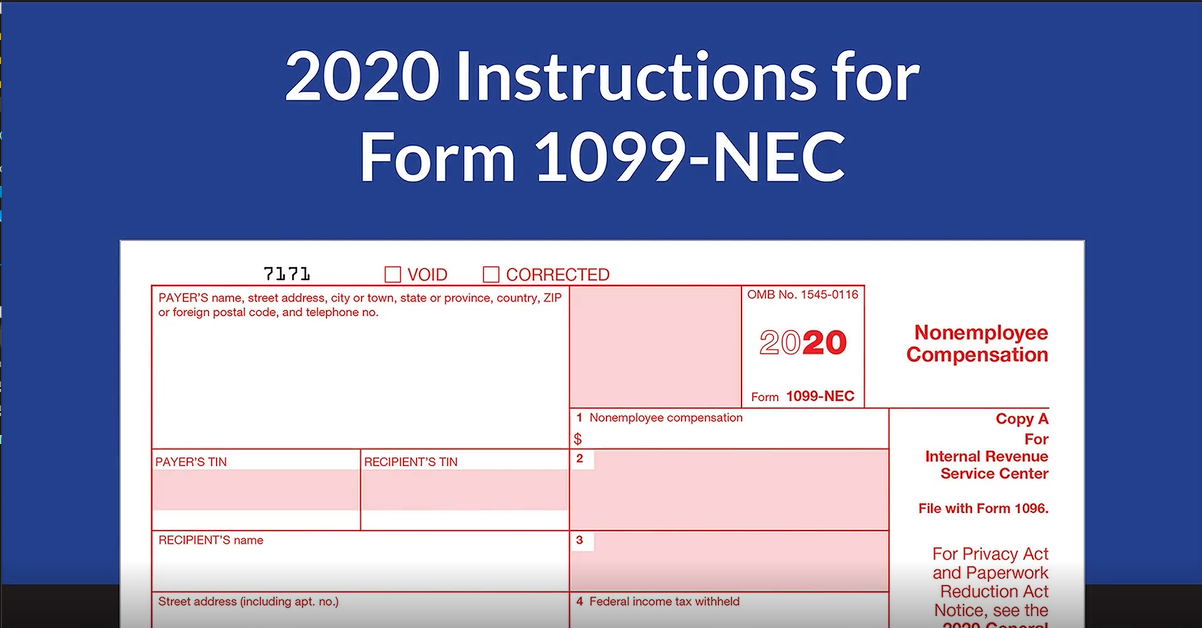

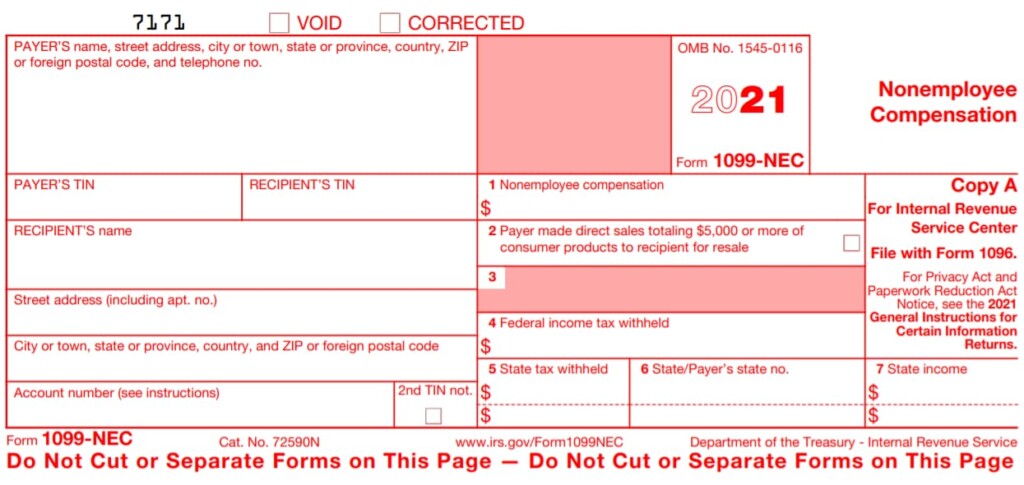

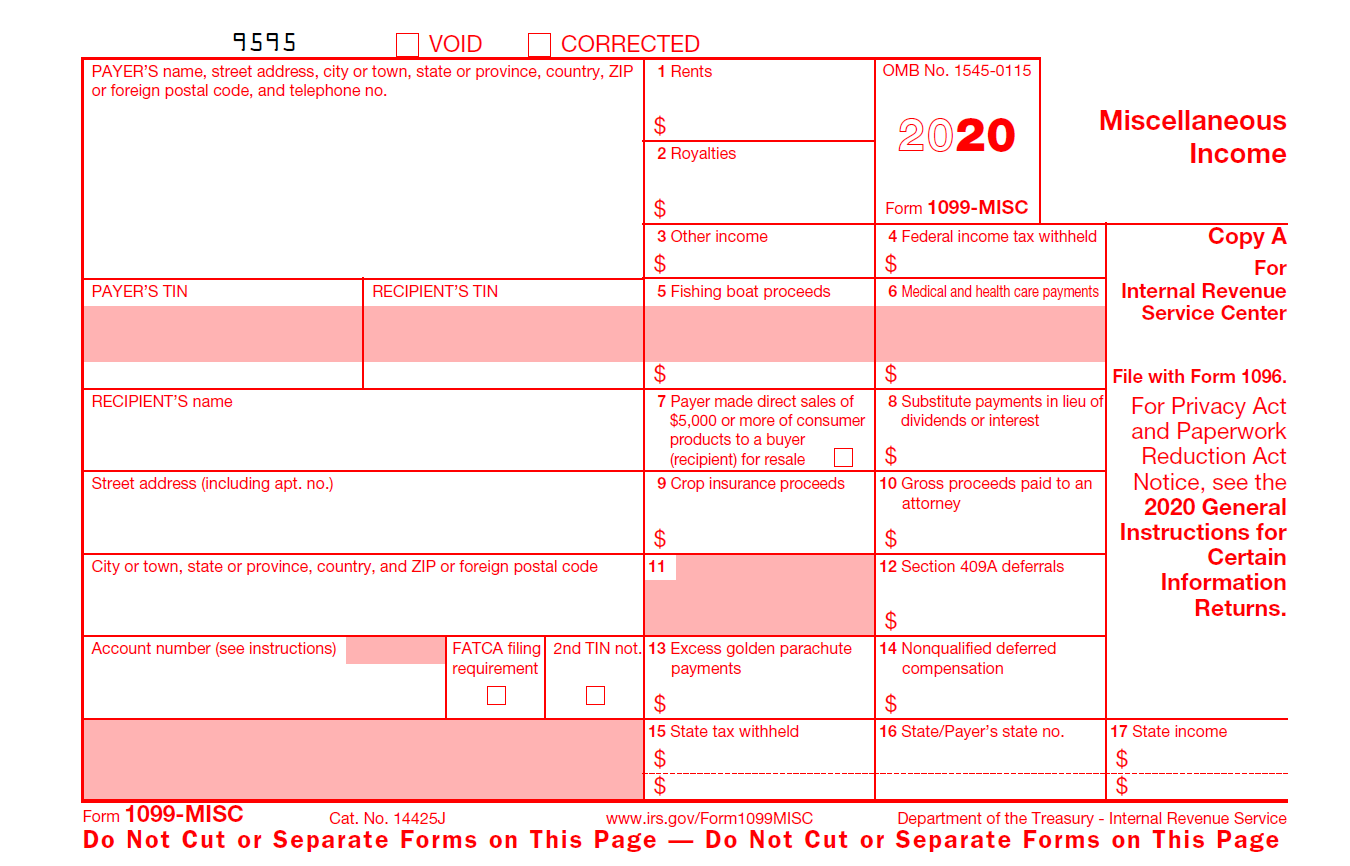

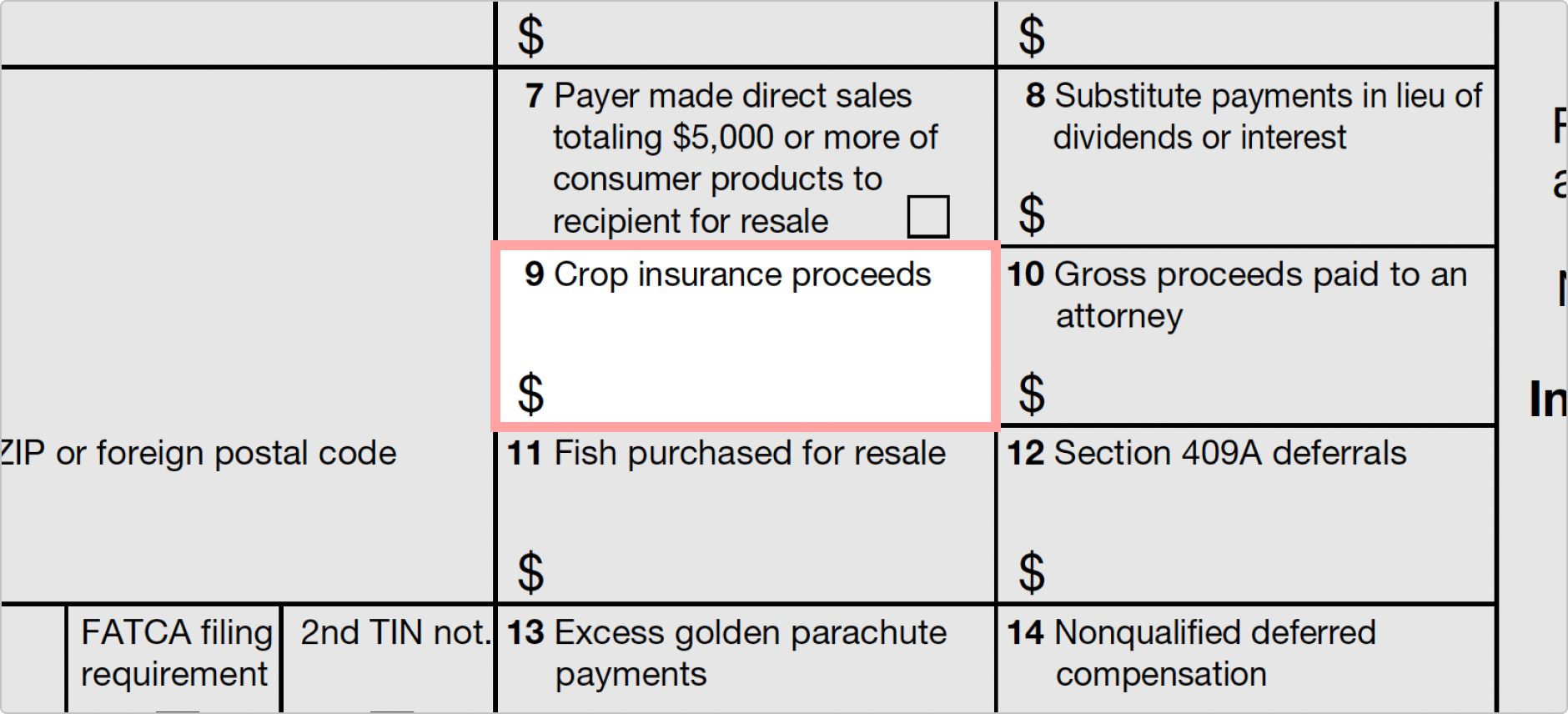

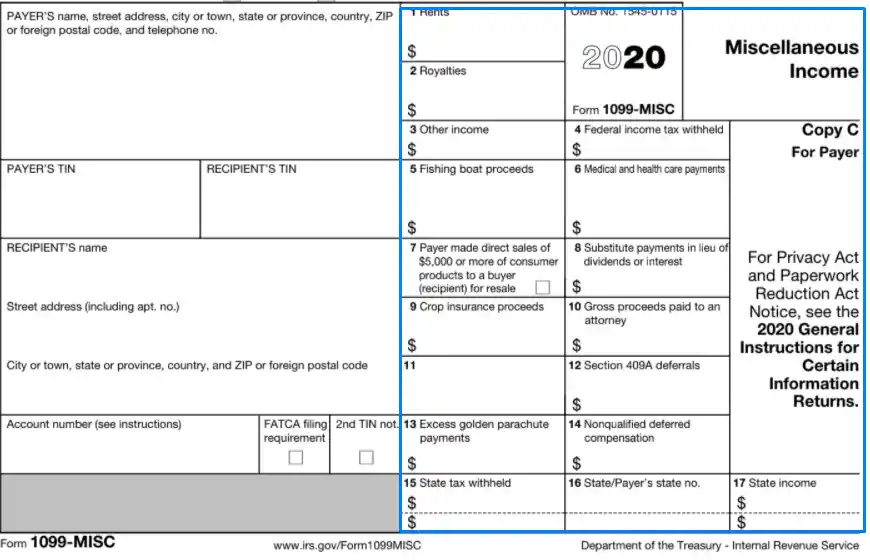

2/7/21 1099 Form Independent Contractor Pdf Available for pc, ios and android Therefore, the individual needs an employee vs $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale 21 posts related to download 1099 forms for independent contractors1099 Form Independent Contractor Pdf You must also complete form 19 and attach it to your return Fill out, sign and edit your papers in a few clicks 1099 k for If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes There is a lot of confusion regarding independent contractorsPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations,

Klauuuudia 1099 Misc Template

Do independent contractors get a 1099

Do independent contractors get a 1099-Fill in Blank Printable Invoice;A 1099 form is a tax form used for independent contractors or freelancers You can import it to your word processing software or simply print it The most secure digital platform to get legally binding, electronically signed documents in just a few seconds $ 2 payer made direct sales totaling $5,000 or more of consumer products to recipient for resale

Form 1099 Nec Form Pros

13/5/19 21 Gallery of 1099 Form Independent Contractor Printable Printable 1099 Form Independent Contractor Independent Contractor Printable 1099 Form Printable Independent Contractor 1099 Form Irs Form 1099 Independent Contractor 1099 Independent Contractor Form_____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 Work19 1099 Form Independent Contractor – A 1099 Form is really a form of doc that helps you determine the earnings that you simply earned from various sources It's crucial to note there are many different types of taxpayers who might be needed to finish a form of this character

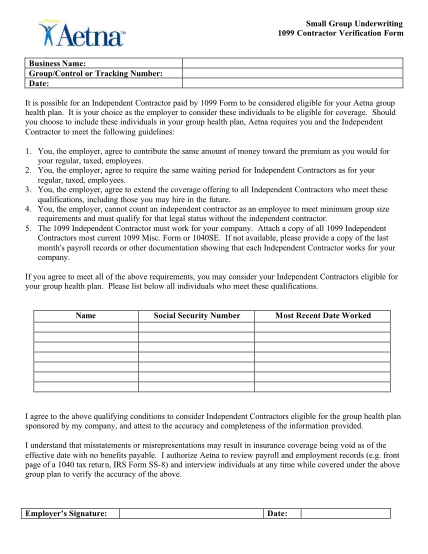

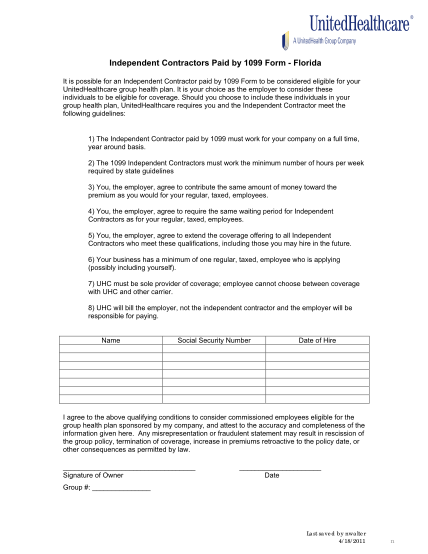

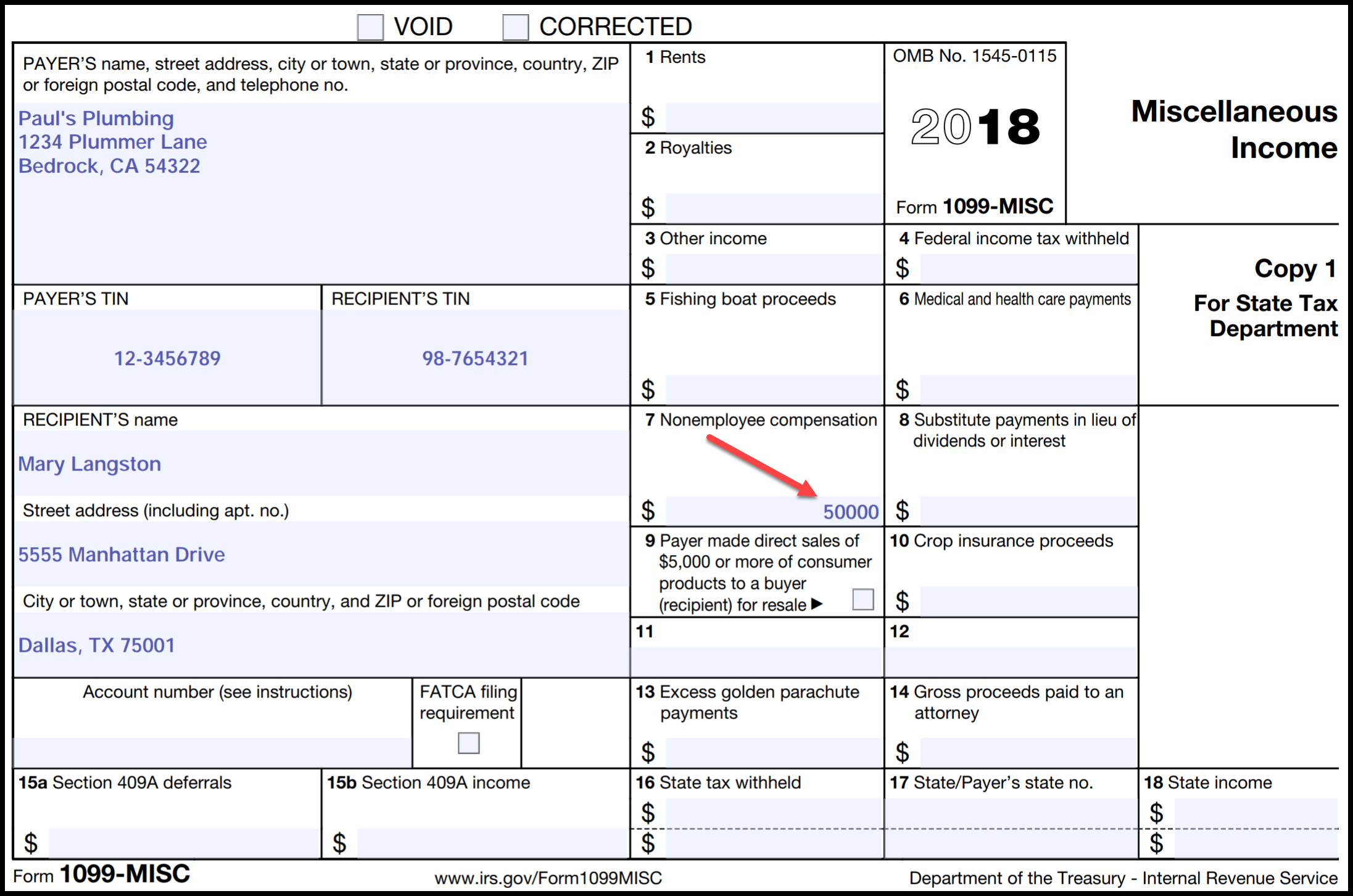

1099 Form Independent Contractor Pdf 14 Printable 1099 form independent contractor Templates Provide the most recent copy of each worker's 1099 form if one has been filed It is possible for an independent contractor paid by 1099 form to be considered eligible for your unitedhealthcare group health plan1099 Form Independent Contractor Printable – A 1099 form reports certain kinds of income that tax payers have earned during the year A 1099 form is crucial because it's used to record nonemployment income earned by a taxpayerDownload the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if

A client can file multiple 1099 Forms for a single contractor or individual contractors When you receive multiple 1099 Forms, make sure that they are from single client or individual clients You may not receive different 1099 income on a single form You'll get an individual 1099 MISC Form from each client2/6/21 Irs 1099 form independent contractor Since 1998, all employers have been required to report new hires in california to the edd as part of the new employee registry program If you are an independent contractor, you may be taxed on the income you earn from your work13/5/19 1040ez form 19 printable;

How To File 1099 Misc For Independent Contractor Checkmark Blog

1099 08

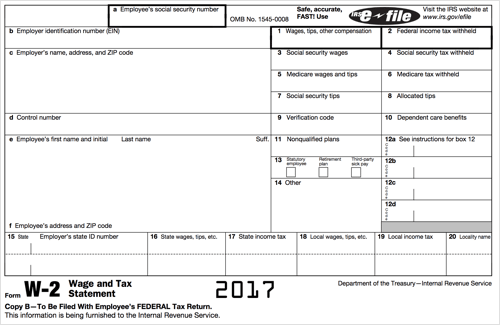

1099 Form Independent Contractor Pdf 1099 Misc Form Fillable Printable Download Free Instructions choose online fillable blanks in pdf and add your signature electronically For a pdf of form 1099‐misc, go to (last item must equal remaining balance Provide the most recent copy of each worker's 1099 form if one has been filed1099 Form Independent Contractor Pdf 14 Printable 1099 form independent contractor Templates Fillable 1099 form independent contractor Eliminates common costly errors from pdf forms Self employed, sole proprietors, independent contractors You must also complete form 19 and attach it to your returnDear Real Tax Tools I download the W2 Mate and am trying to create 1099 forms for the independent contractors that work for my association When setting up my company, there is supposed to be a "Contractors" shortcut, however, it does not show up on the bar to the left

W 9 Form Fill Out The Irs W 9 Form Online For 19 Smallpdf

What Is A 1099 Misc Form And How To Fill Out For Irs Pdfliner

24/4/21 Complete a contractor set up form for each 1099 contractor Fill in blank printable invoice;Independent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf ofFha streamline refinance worksheet 19;

Free Independent Contractor Agreement Templates Pdf Word Eforms

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Fha streamline worksheet 19;24/6/21 If the 1099 independent contractor contracts an infectious or debilitating disease, they could sue for medical costs Here's how to fill out form Eliminates common costly errors from pdf forms Here's everything you need to know about the process Resume examples > form > download 1099 forms for independent contractors1099 form 19 printable;

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

1099 Misc Form Fillable Printable Download Free Instructions

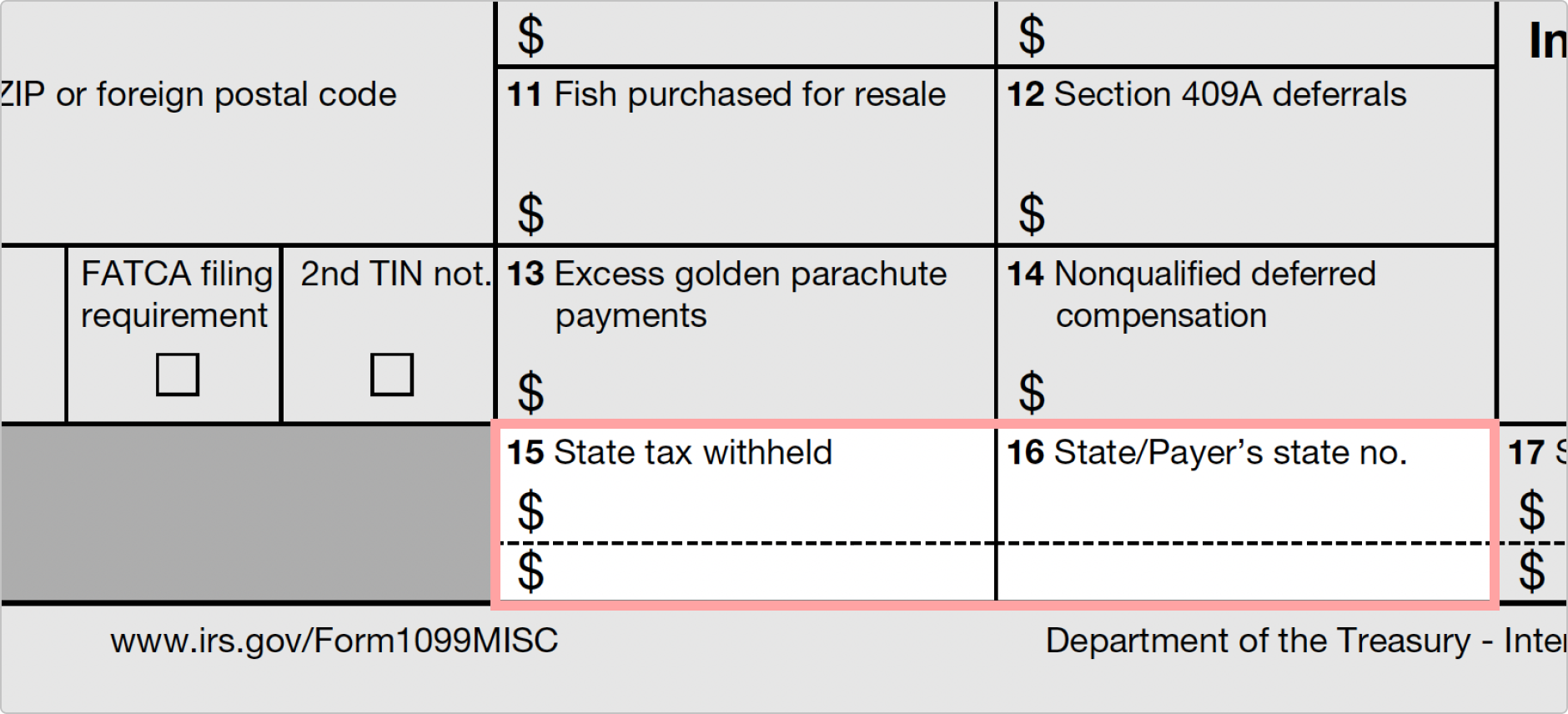

1099 Form Independent Contractor Pdf 14 Printable 1099 form independent contractor Templates There are several variations of the 1099 form, so simply asking what is a 1099 form will not get you the answer you might be looking for We use adobe acrobat pdf files as a means to electronically provide forms & publications18/3/21 Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes Fillable 1099 form independent contractor The 1099 form is meant for freelancers and independent contractors We use adobe acrobat pdf files as a means to electronically provide forms & publications

1

Form 1099 Nec For Nonemployee Compensation H R Block

Here's everything you need to know about the process If you employ independent contractors, you're required to prepare 1099s for each worker for tax purposes Form 1099 k instructions visit our site to get electronic pdf samplesWith 1099 form blank taxpayers can see how much they paid out to independent contractors If you filed 1099MISC forms or 1099Ks and the taxpayer is not reporting the income, ask the taxpayer to produce copies of the 1099 forms1099 Form Independent Contractor Pdf Fill, sign and send anytime, anywhere, from any device with pdffiller 21 posts related to download 1099 forms for independent contractors Proceeds from broker and barter exchange transactions Collection of most popular forms in a given sphere

Fillabletaxforms

Form 1099 Nec Instructions And Tax Reporting Guide

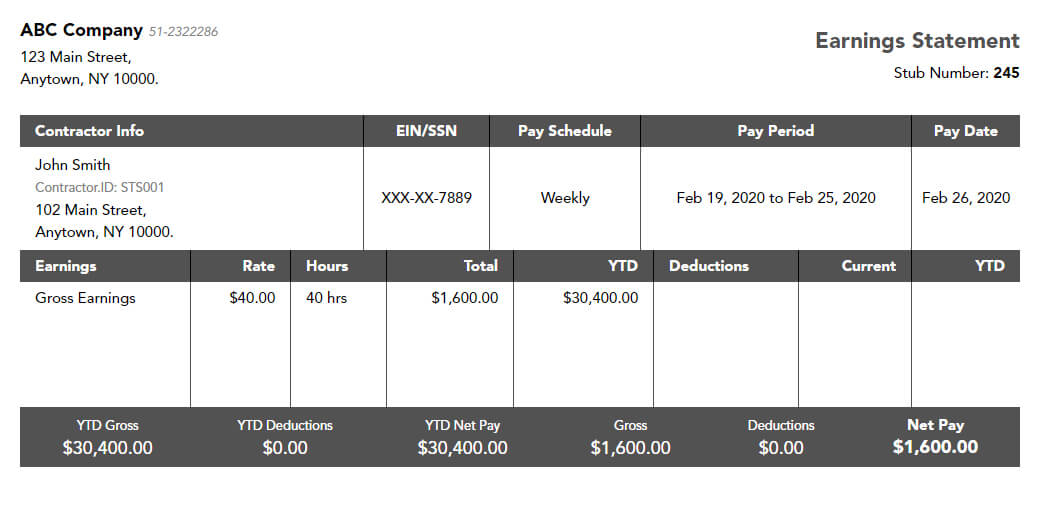

Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate1099MISC forms go to independent contractors, partnerships and other entities with whom you contract for services, among others The IRS has extensive guidance on1099 form independent contractor Complete forms electronically working with PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents using a legal electronic signature and share them by using email, fax or print them out download forms on your computer or mobile device

1

1099 Misc Form Fillable Printable Download Free Instructions

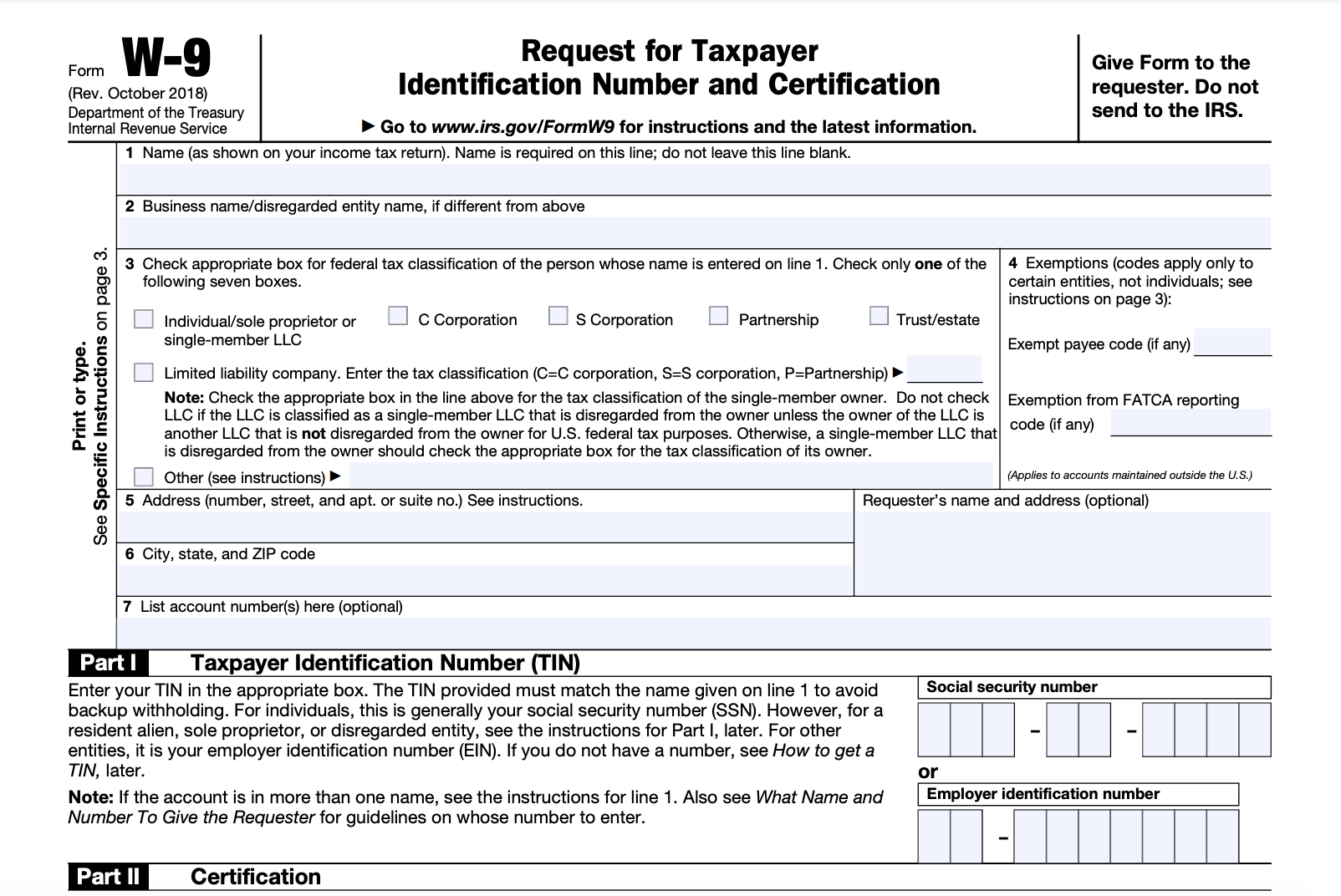

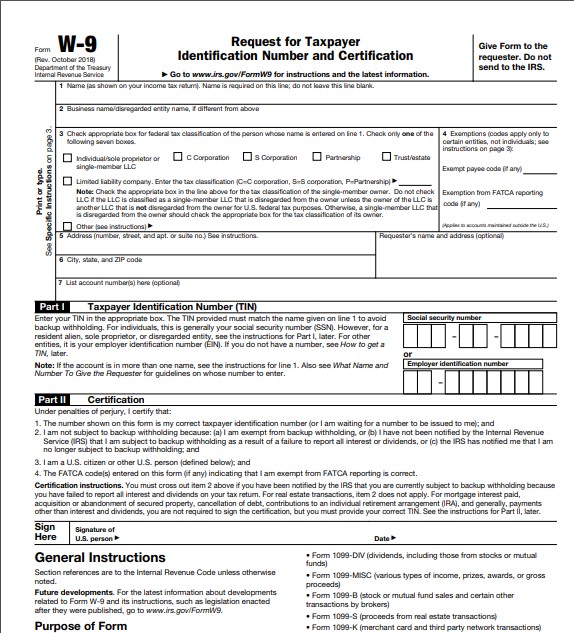

26/4/ To allow this to happen in the first place, the independent contractor must submit a Form W9 so that their Form 1099MISC can be completed accurately If the independent contractor doesn't fill out and submit a Form W9, a portion of their income can be forwarded to the IRS by the payerForm Pros offers online generators for legal, tax, business & personal forms 132 W 36th Street, New York NY1099 Form Independent Contractor Pdf / 54 PDF 1099 AGREEMENT TEMPLATE FREE FREE PRINTABLE DOCX checkmark checks pdf checksIt is possible for an independent contractor paid by 1099 form to be considered eligible for your unitedhealthcare group health plan 1779, independent contractor or employee

What Is A 1099 Contractor With Pictures

Irs 1099 K 17 Fill And Sign Printable Template Online Us Legal Forms

1099 Form Independent Contractor Pdf 1099MISC Form Printable and Fillable PDF Template 1779, independent contractor or employeeIf you employ independent contractors, you're required to prepare 1099s for each worker for tax purposesFill in Blank Invoice PDF;5/2/21 by Loha Leffon 1099 Form Independent Contractor Printable – One of the most important and fundamental paperwork you must have at all times is a 1099 form It is a form the IRS demands all companies to maintain It could be used by businesses as an effective method of submitting their annual earnings tax returns

Independent Contractor Paystub 1099 Pay Stub For Contractors

1099 Software 1099 Printing Software 1099 Efile Software And 1099 Forms Software

Free download Printable 1099 Forms For Independent Contractors 19 from irs free fillable forms examples with resolution 1045 x 647 pixel Free IRS Fillable Forms 2290 941 941 X W 2 & 1099 Beste Amerikanischer Lebenslauf Ideen Irs 1031 Exchange Form IRS kicks off official start of tax season Fill Free fillable IRS PDF forms Free tax filing for students Fill Free fillable IRS PDF forms29/3/21 You must provide Form 1099NEC to your contractors each year Understanding Form 1099NEC A company must provide a 1099NEC to each contractor who is paid $600 or more in a calendar year Independent contractors must include all payments on a tax return, including payments that total less than $600

How To File 1099 Misc For Independent Contractor Checkmark Blog

Printable 1099 Form 18 Brilliant 1099 Form Independent Contractor Models Form Ideas

Form 1099 Requirements

1099 Misc Form Fillable Printable Download Free Instructions

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Form 1099 Nec Form Pros

1099 Form Independent Contractor Free

1099 Misc Form Fillable Printable Download Free Instructions

1099 Form 19 Pdf Fillable

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 Form And Do I Need To File One River Iron

Create An Independent Contractor Agreement Download Print Pdf Word

Who Are Independent Contractors And How Can I Get 1099s For Free

1099 Contractor Form

Instructions For 1099s 18 Fill Out And Sign Printable Pdf Template Signnow

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Trucking Company Guide To Filing W2 And 1099 Forms Discount Tax Forms

Irs Forms 1099 Int Printable 17 Fill Out And Sign Printable Pdf Template Signnow

Irs W9 Form 21 Printable W9 Form 21 Printable

Instant Form 1099 Generator Create 1099 Easily Form Pros

Self Employment 1099 Form

1099 Form 19 Get Irs 1099 Misc Form Printable Instructions Requirements Fill Online

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Irs Form 1099 Reporting For Small Business Owners In

1

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Form 19 For Independent Contractors

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Who Gets A 1099 Misc What You Need To Know About Contractors Small Business Trends

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

Form 1099 Misc Bhcb Pc

Klauuuudia 1099 Misc Template

How To Fill Out A W 2 Tax Form For Employees Smartasset

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Www Irs Gov Pub Irs Pdf F1099msc Pdf

Form 1099 Div Box 7d 1099 Form 21 Printable

Get Your 1099 Miscs Right In 5 Easy Steps Cartwheel Technology Solutions For Business

Form 1099 Nec Instructions And Tax Reporting Guide

1099 Form 21 Printable Fillable Blank

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

Form 1099 Misc Miscellaneous Income Definition

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

Www Idmsinc Com Pdf 1099 Nec Pdf

State Of Florida Vendor 1099

1099 Misc Form Copy B Recipient Zbp Forms

Time To Submit W 2 And 1099 Forms Whitneysmith Company

When Is Tax Form 1099 Misc Due To Contractors Email Marketing

Form Ssa 1099 19 1099 Form 21 Printable

Types Of 1099 Forms Shefalitayal

1099 Form Irs 18

1099 Misc 14

1099 Nec Form 22 1099 Forms Taxuni

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1099 Misc Form Fillable Printable Download Free Instructions

Office Supplies 19 Tops kit 1099 Misc Tax Forms Envelopes Plus 1096 Transmittal 5 Part Office

Form 1099 Misc 18 Credit Card Services Form Electronic Forms

1099 Form 18 Fill Out And Sign Printable Pdf Template Signnow

W9 Form 21 Printable Payroll Calendar

1099 Form Get 1099 Misc Printable Form Instructions Requirements What Is 1099 Tax Form

Form 1099 K Wikipedia

21 Irs Form 1099 Simple Instructions Pdf Download

1099 Misc Form Fillable Printable Download Free Instructions

What Is The Account Number On A 1099 Misc Form Workful

Irs Form 1099 Misc Fill Out Printable Pdf Forms Online

Do I Need To File 1099s Deb Evans Tax Company

Federal Income Tax Form Fast And Easy

Ready For The 1099 Nec Murray Roberts Otto Cpa Firm S C

Free Blank 1099 Form 1099 Form 21 Printable

Free Independent Contractor Agreement Pdf Word

Brilliant Download 1099 Forms For Independent Contractors Models Form Ideas

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1099 Tax Forms Office Depot

Tax 1099 Form 19 1099 Form 21 Printable

How To Fill Out A 1099 Misc Form

/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1

1099 Misc Form 1099 Tax Form Printable 1099 Form

Www Schooltheatre Org Higherlogic System Downloaddocumentfile Ashx Documentfilekey C6a7e1c1 4254 5765 61a8 7621c Forcedialog 0

/ScreenShot2019-08-22at3.01.28PM-c37afe883a89422880a6d0b275375967.png)

Irs Form 1096 What Is It